Plant-based protein company Beyond Meat (NASDAQ:BYND) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 7.6% year on year to $81.01 million. The company expects the full year’s revenue to be around $325 million, close to analysts’ estimates. Its non-GAAP loss of $0.41 per share was also 12.3% above analysts’ consensus estimates.

Is now the time to buy Beyond Meat? Find out by accessing our full research report, it’s free.

Beyond Meat (BYND) Q3 CY2024 Highlights:

- Revenue: $81.01 million vs analyst estimates of $80.19 million (1% beat)

- Adjusted EPS: -$0.41 vs analyst estimates of -$0.47

- EBITDA: -$19.76 million vs analyst estimates of -$20.69 million (4.5% beat)

- The company dropped its revenue guidance for the full year to $325 million at the midpoint from $330 million, a 1.5% decrease

- Gross Margin (GAAP): 17.7%, up from -9.6% in the same quarter last year

- Operating Margin: -38.2%, up from -92.4% in the same quarter last year

- EBITDA Margin: -24.4%, up from -76.3% in the same quarter last year

- Free Cash Flow was -$24.07 million, down from $7.63 million in the same quarter last year

- Sales Volumes fell 12.6% year on year (3.5% in the same quarter last year)

- Market Capitalization: $414.9 million

Beyond Meat President and CEO Ethan Brown commented, “We are pleased to report that in the third quarter we returned to growth, increasing net revenues on a year-over-year basis, while continuing to expand gross margin and reduce operating expenses on both a sequential and year-over-year basis. Looking ahead, we expect to increase our cash reserves by year-end and pursue further balance sheet restructuring in 2025.”

Company Overview

A pioneer at the forefront of the plant-based protein revolution, Beyond Meat (NASDAQ:BYND) is a food company crafting innovative, sustainable, and delicious alternatives to traditional meat products.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Sales Growth

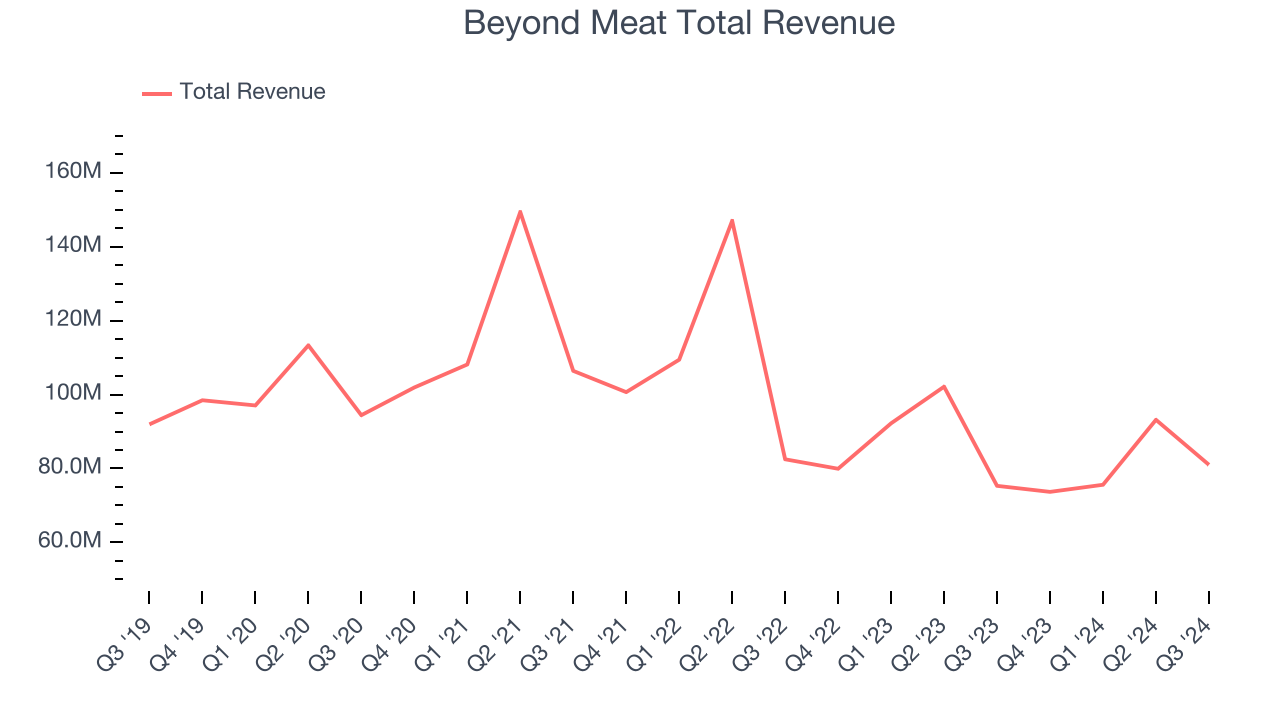

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Beyond Meat is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from economies of scale.

As you can see below, Beyond Meat struggled to generate demand over the last three years. Its sales dropped by 11.5% annually as consumers bought less of its products.

This quarter, Beyond Meat reported year-on-year revenue growth of 7.6%, and its $81.01 million of revenue exceeded Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 7% over the next 12 months, an acceleration versus the last three years. This projection is above average for the sector and indicates the market thinks its newer products will spur faster growth.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Volume Growth

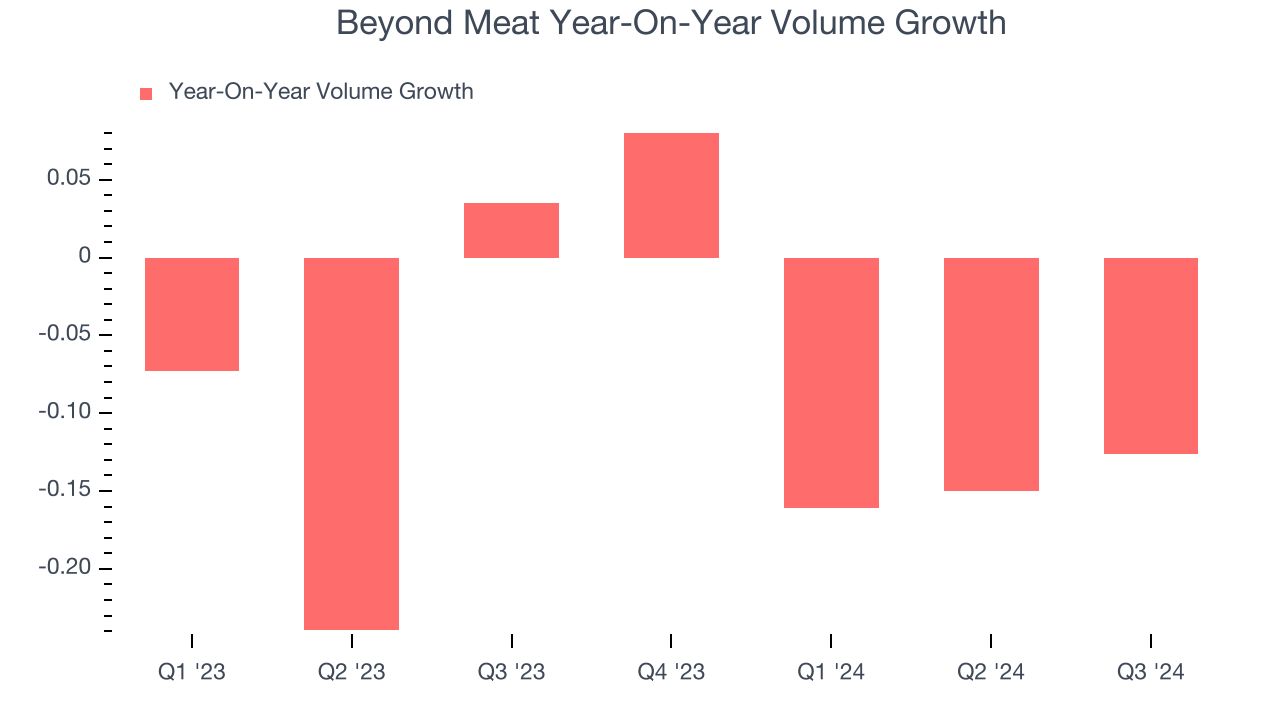

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Beyond Meat’s average quarterly sales volumes have shrunk by 9.1% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

In Beyond Meat’s Q3 2024, sales volumes dropped 12.6% year on year. This result was a reversal from the 3.5% year-on-year increase it posted 12 months ago. A one quarter hiccup shouldn’t deter you from investing in a business. We’ll be monitoring the company to see how things progress.

Key Takeaways from Beyond Meat’s Q3 Results

We enjoyed seeing Beyond Meat exceed analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. However, the company lowered its full year revenue guidance, which is never a good sign, and this seems to be weighing on shares. The stock traded down 5.8% to $6.20 immediately after reporting.

Is Beyond Meat an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.