Let’s dig into the relative performance of BlackLine (NASDAQ:BL) and its peers as we unravel the now-completed Q3 finance and HR software earnings season.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 12 finance and HR software stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was 1% below.

Luckily, finance and HR software stocks have performed well with share prices up 10.4% on average since the latest earnings results.

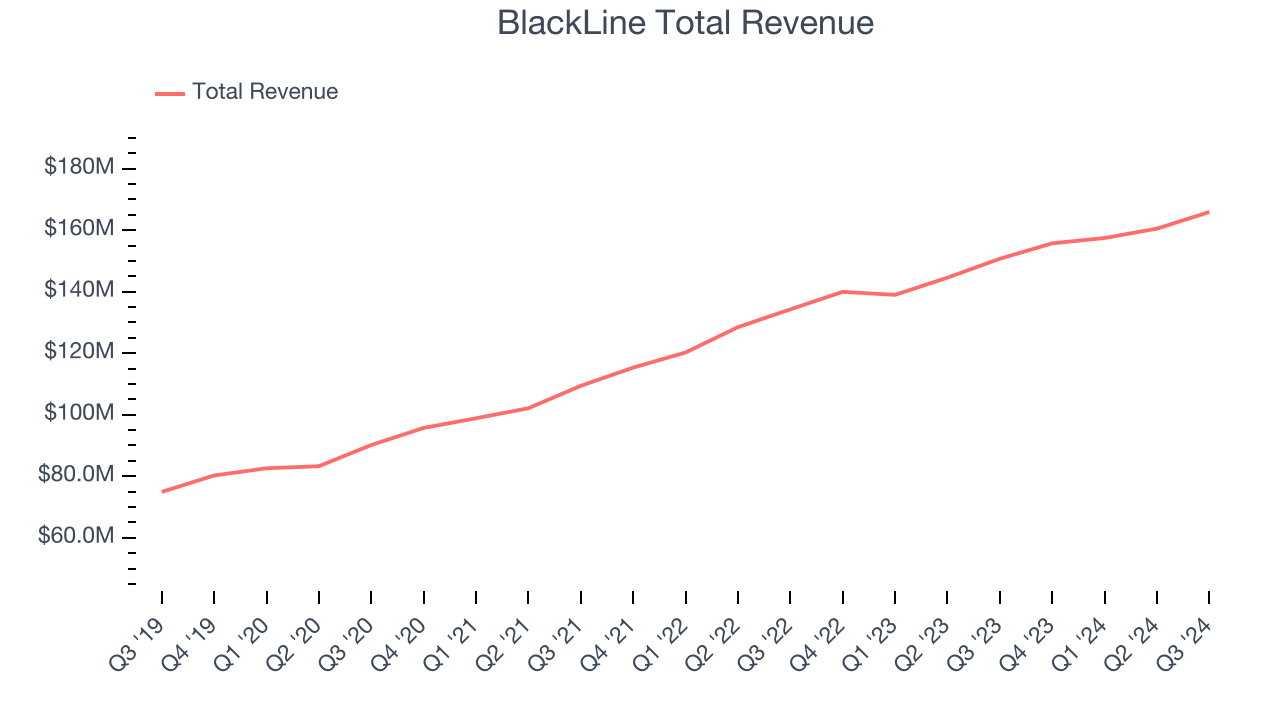

BlackLine (NASDAQ:BL)

Started in 2001 by software engineer Therese Tucker, one of the very few women founders who took their companies public, BlackLine (NASDAQ:BL) provides software for organizations to automate accounting and finance tasks.

BlackLine reported revenues of $165.9 million, up 10.1% year on year. This print exceeded analysts’ expectations by 1.7%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ EBITDA estimates but decelerating customer growth.

“BlackLine delivered another quarter of solid financial results, exceeding our financial guidance while achieving record free cash flow generation," said Owen Ryan, co-CEO of BlackLine.

Interestingly, the stock is up 8.2% since reporting and currently trades at $64.36.

Read our full report on BlackLine here, it’s free.

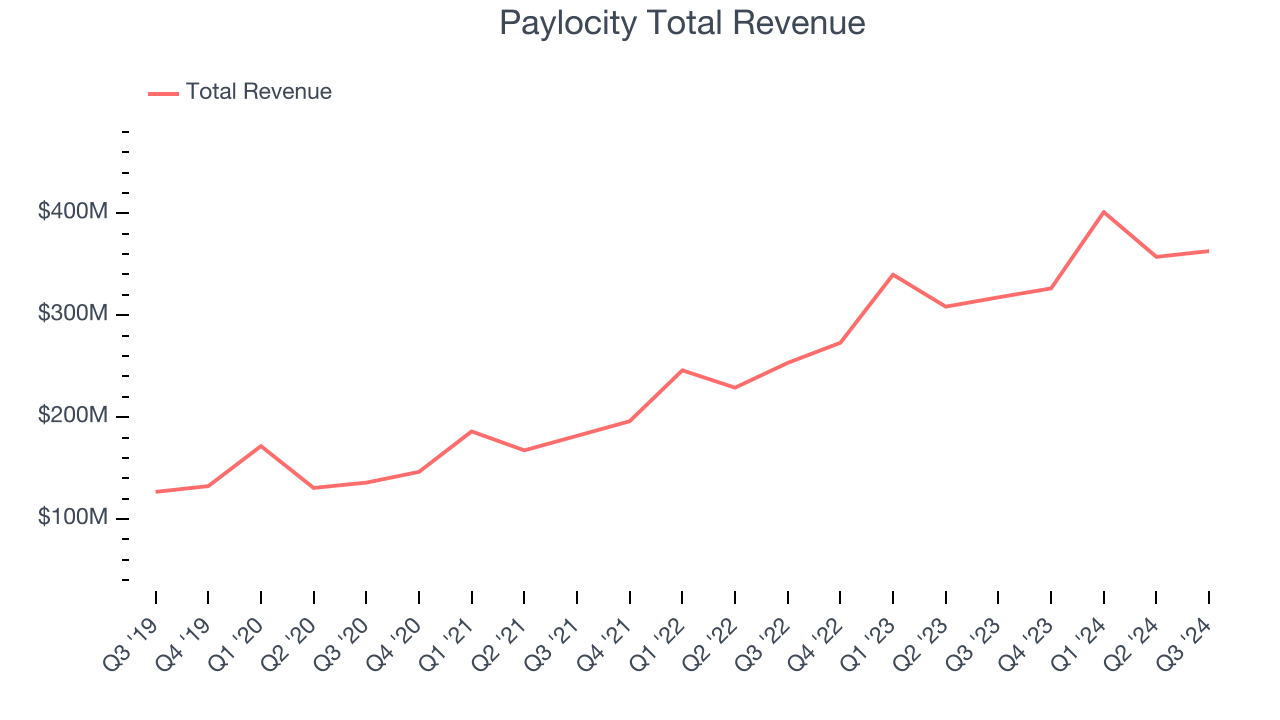

Best Q3: Paylocity (NASDAQ:PCTY)

Founded by payroll software veteran Steve Sarowitz in 1997, Paylocity (NASDAQ:PCTY) is a provider of payroll and HR software for small and medium-sized enterprises.

Paylocity reported revenues of $363 million, up 14.3% year on year, outperforming analysts’ expectations by 1.9%. The business had a strong quarter with a solid beat of analysts’ EBITDA estimates and revenue guidance for next quarter topping analysts’ expectations.

The market seems happy with the results as the stock is up 13.6% since reporting. It currently trades at $202.73.

Is now the time to buy Paylocity? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Asure (NASDAQ:ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ:ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure reported revenues of $29.3 million, flat year on year, falling short of analysts’ expectations by 6.5%. It was a disappointing quarter as it posted revenue guidance for next quarter missing analysts’ expectations.

Asure delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update in the group. As expected, the stock is down 4.5% since the results and currently trades at $9.49.

Read our full analysis of Asure’s results here.

Marqeta (NASDAQ:MQ)

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ:MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

Marqeta reported revenues of $128 million, up 17.5% year on year. This result was in line with analysts’ expectations. Taking a step back, it was a mixed quarter as it also produced an impressive beat of analysts’ EBITDA estimates but revenue guidance for next quarter missing analysts’ expectations significantly.

The stock is down 32.3% since reporting and currently trades at $4.04.

Read our full, actionable report on Marqeta here, it’s free.

Workiva (NYSE:WK)

Founded in 2010, Workiva (NYSE:WK) offers software as a service product that makes financial and compliance reporting easier, especially for publicly traded corporations.

Workiva reported revenues of $185.6 million, up 17.4% year on year. This number topped analysts’ expectations by 1.7%. More broadly, it was a satisfactory quarter as it also logged an impressive beat of analysts’ billings estimates but EPS guidance for next quarter missing analysts’ expectations significantly.

The company added 158 enterprise customers paying more than $100,000 annually to reach a total of 1,926. The stock is up 18.1% since reporting and currently trades at $103.55.

Read our full, actionable report on Workiva here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.