As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the electronic components industry, including Vicor (NASDAQ:VICR) and its peers.

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

The 12 electronic components stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 3.6% below.

While some electronic components stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.9% since the latest earnings results.

Best Q3: Vicor (NASDAQ:VICR)

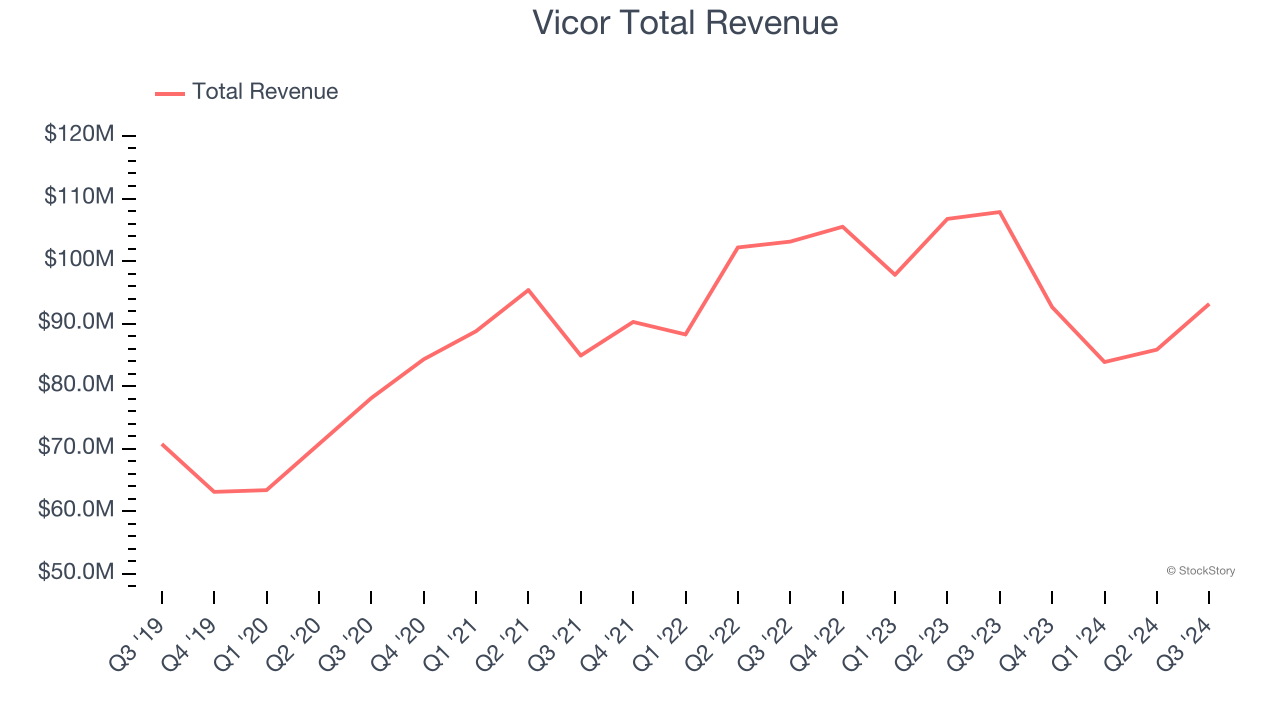

Founded by a researcher at the Massachusetts Institute of Technology, Vicor (NASDAQ:VICR) provides electrical power conversion and delivery products for a range of industries.

Vicor reported revenues of $93.17 million, down 13.6% year on year. This print exceeded analysts’ expectations by 9.3%. Overall, it was an incredible quarter for the company with a solid beat of analysts’ EPS estimates.

Commenting on third quarter performance, Chief Executive Officer Dr. Patrizio Vinciarelli stated: “Revenues and cash flow improved in Q3 while gross margins were impacted primarily by product mix. We are close to initial deliveries of 2nd generation, high density VPD systems for leading AI applications with current multipliers achieving superior density, bandwidth and signal integrity. Vicor’s VPD will enable AI processors setting new standards for compute performance and power system efficiency.”

Vicor scored the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 13.6% since reporting and currently trades at $49.31.

Is now the time to buy Vicor? Access our full analysis of the earnings results here, it’s free.

Allient (NASDAQ:ALNT)

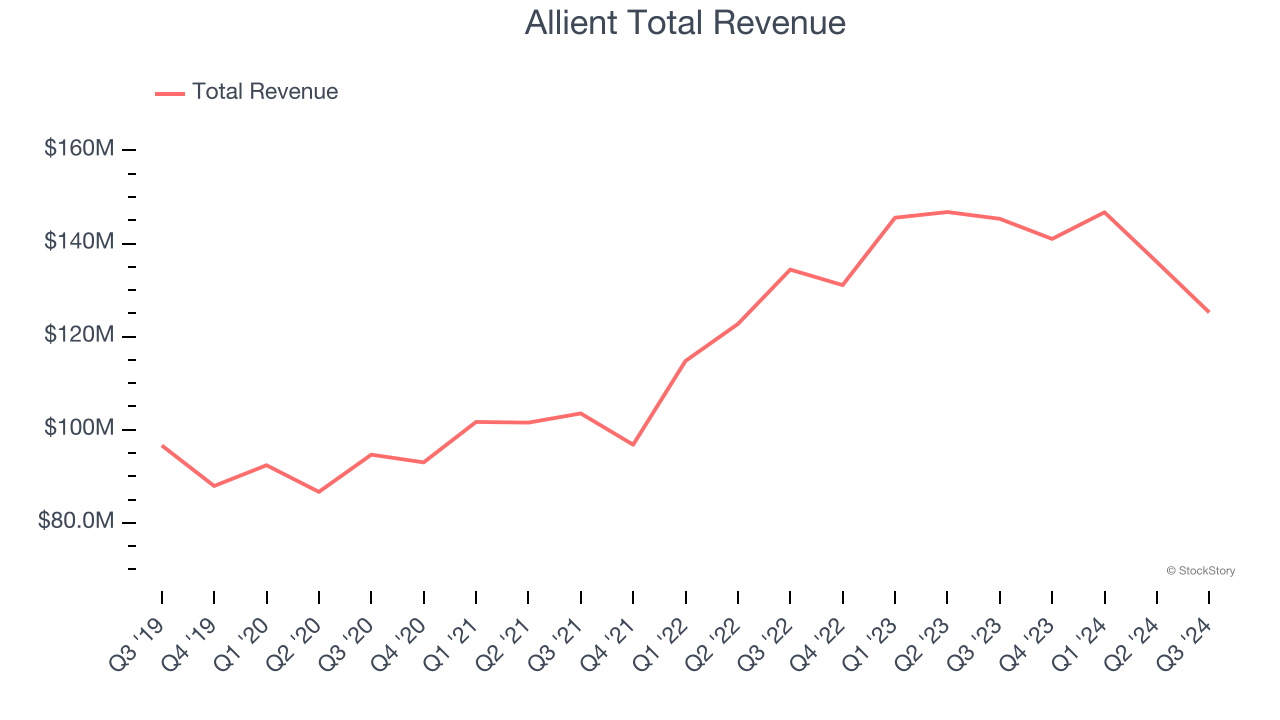

Founded in 1962, Allient (NASDAQ:ALNT) develops and manufactures precision and specialty-controlled motion components and systems.

Allient reported revenues of $125.2 million, down 13.8% year on year, outperforming analysts’ expectations by 0.6%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 15.3% since reporting. It currently trades at $23.61.

Is now the time to buy Allient? Access our full analysis of the earnings results here, it’s free.

Novanta (NASDAQ:NOVT)

Originally a pioneer in the laser scanning industry during the late 1960s, Novanta (NASDAQ:NOVT) offers medicine and manufacturing technology to the medical, life sciences, and manufacturing industries.

Novanta reported revenues of $244.4 million, up 10.3% year on year, exceeding analysts’ expectations by 0.9%. Still, it was a softer quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

As expected, the stock is down 11.8% since the results and currently trades at $153.82.

Read our full analysis of Novanta’s results here.

Corning (NYSE:GLW)

Supplying windows for some of the United States’s earliest spacecraft, Corning (NYSE:GLW) provides glass and other electronic components for the consumer electronics, telecommunications, automotive, and healthcare industries.

Corning reported revenues of $3.73 billion, up 7.9% year on year. This result was in line with analysts’ expectations. It was a satisfactory quarter as it also produced an impressive beat of analysts’ Optical Communications revenue estimates.

The stock is flat since reporting and currently trades at $47.30.

Read our full, actionable report on Corning here, it’s free.

Bel Fuse (NASDAQ:BELFA)

Founded by 26-year-old Elliot Bernstein during the electronics boom after WW2, Bel Fuse (NASDAQ:BELF.A) provides electronic systems and devices to the telecommunications, networking, transportation, and industrial sectors.

Bel Fuse reported revenues of $123.6 million, down 22.1% year on year. This result topped analysts’ expectations by 0.8%. However, it was a slower quarter as it logged a significant miss of analysts’ EPS estimates and revenue guidance for next quarter missing analysts’ expectations.

Bel Fuse had the slowest revenue growth among its peers. The stock is down 10.7% since reporting and currently trades at $91.92.

Read our full, actionable report on Bel Fuse here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.