Over the past six months, Verra Mobility’s stock price fell to $23.74. Shareholders have lost 13.3% of their capital, which is disappointing considering the S&P 500 has climbed by 9.7%. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Given the weaker price action, is now a good time to buy VRRM? Find out in our full research report, it’s free.

Why Is Verra Mobility a Good Business?

Managing over 165 million tolling transactions per year, Verra Mobility (NYSE:VRRM) is a leading provider of smart mobility technology that enhances safety, efficiency, and convenience on roadways.

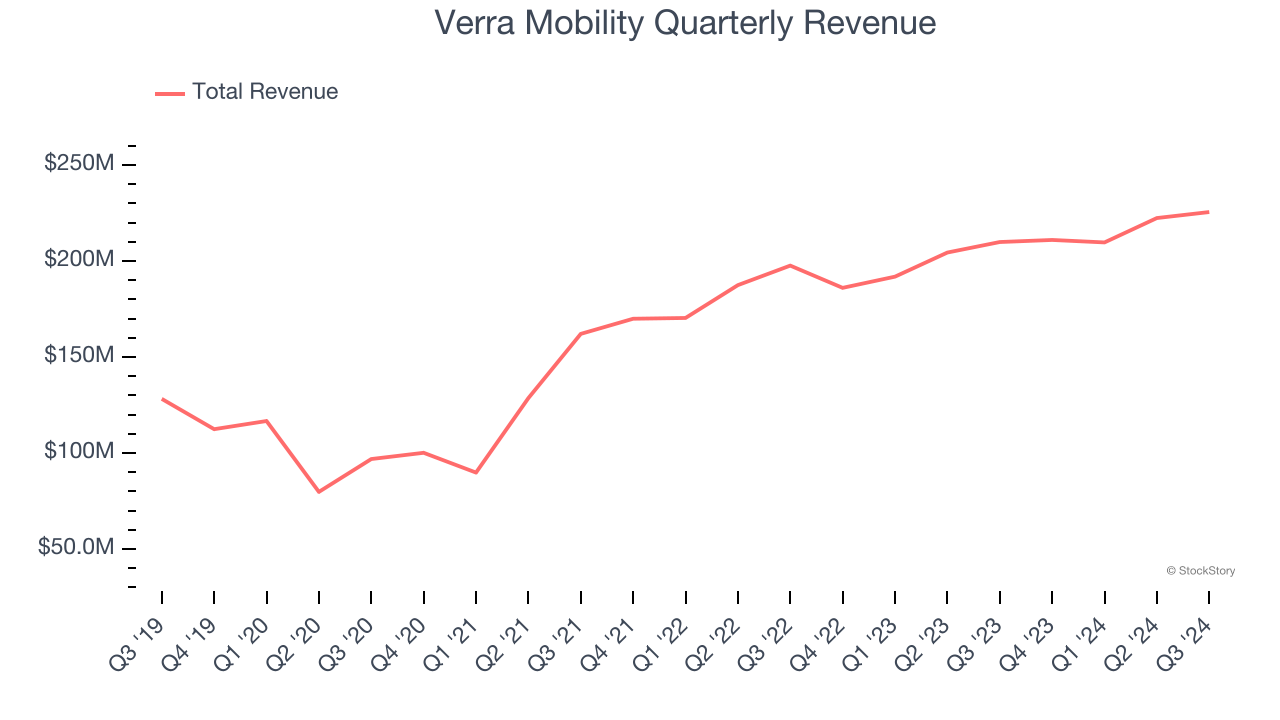

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Verra Mobility grew its sales at an incredible 15% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

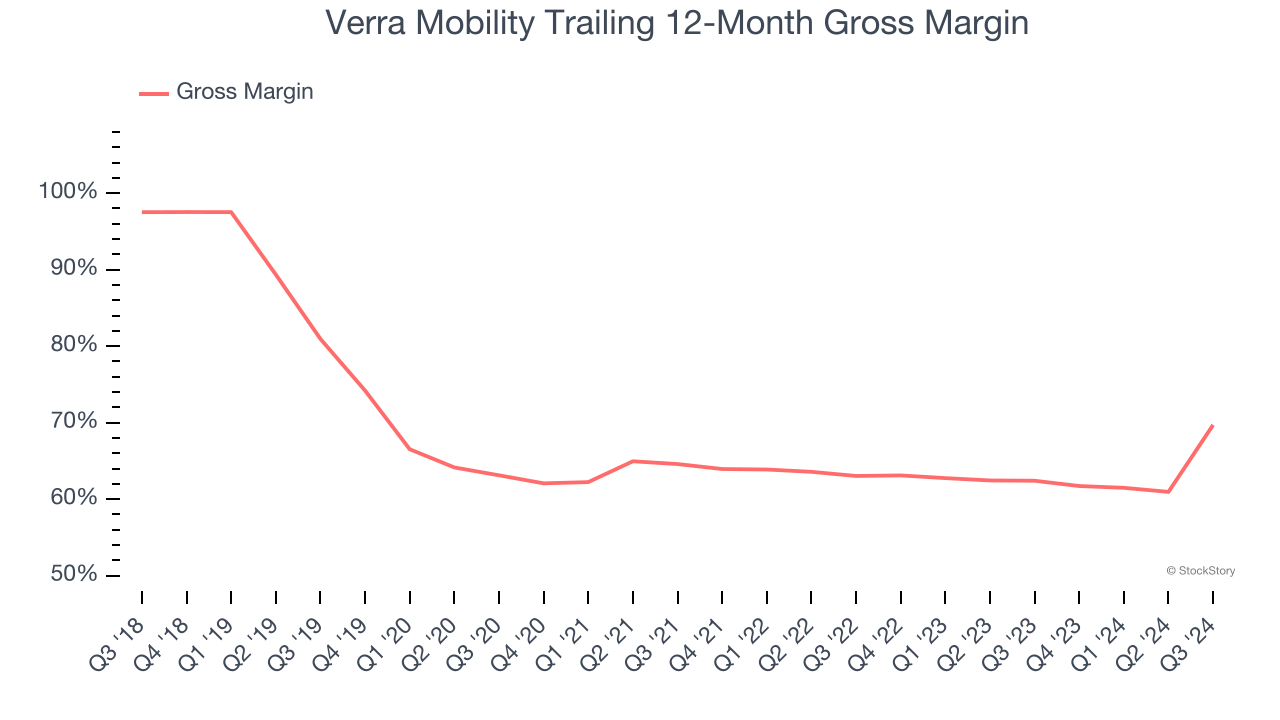

2. Elite Gross Margin Powers Best-In-Class Business Model

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Verra Mobility has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 64.9% gross margin over the last five years. Said differently, roughly $64.90 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

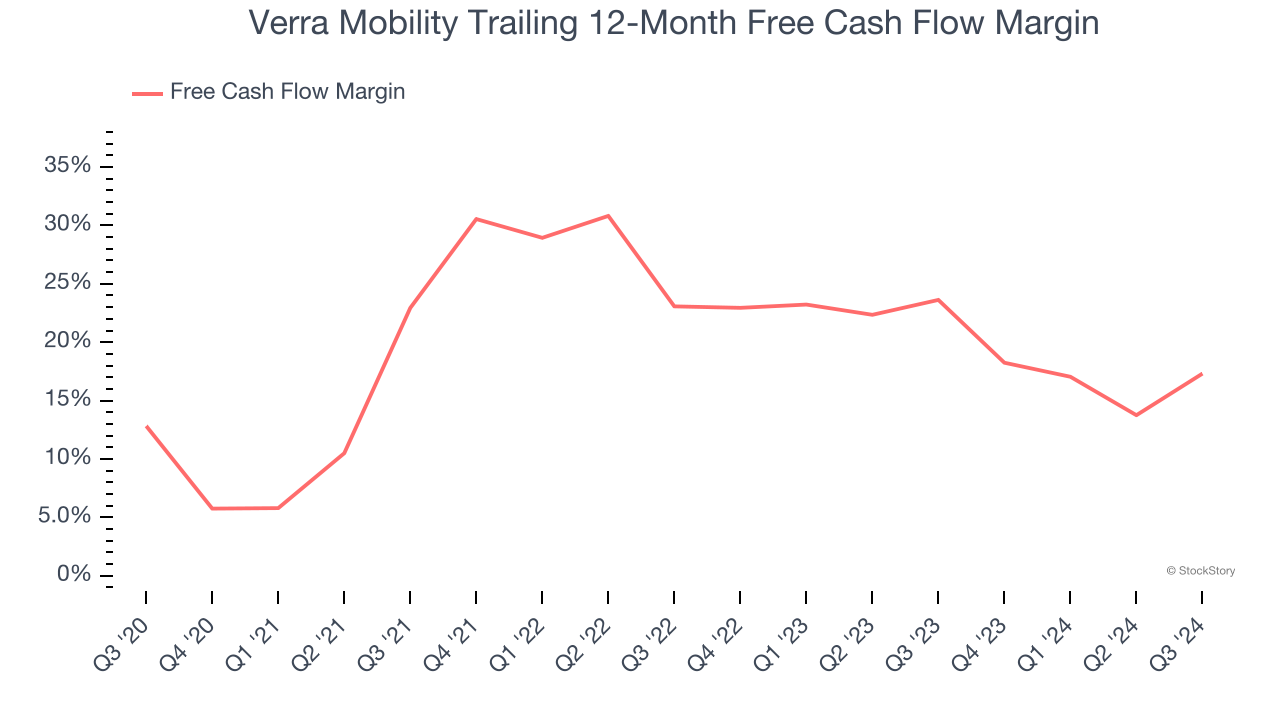

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Verra Mobility has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 20.4% over the last five years.

Final Judgment

These are just a few reasons why we think Verra Mobility is a great business. With the recent decline, the stock trades at 17.9× forward price-to-earnings (or $23.74 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Verra Mobility

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.