Footwear and apparel conglomerate Deckers (NYSE:DECK) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 17.1% year on year to $1.83 billion. On the other hand, the company’s full-year revenue guidance of $4.9 billion at the midpoint came in 0.7% below analysts’ estimates. Its GAAP profit of $3 per share was 14.9% above analysts’ consensus estimates.

Is now the time to buy Deckers? Find out by accessing our full research report, it’s free.

Deckers (DECK) Q4 CY2024 Highlights:

- Revenue: $1.83 billion vs analyst estimates of $1.73 billion (17.1% year-on-year growth, 5.5% beat)

- EPS (GAAP): $3 vs analyst estimates of $2.61 (14.9% beat)

- The company lifted its revenue guidance for the full year to $4.9 billion at the midpoint from $4.8 billion, a 2.1% increase

- EPS (GAAP) guidance for the full year is $5.78 at the midpoint, beating analyst estimates by 2.4%

- Operating Margin: 31%, in line with the same quarter last year

- Constant Currency Revenue rose 16.6% year on year (15.1% in the same quarter last year)

- Market Capitalization: $33.26 billion

“Deckers posted exceptional results in the third quarter, delivering record quarterly revenue, gross margin, and earnings,” said Stefano Caroti, President and Chief Executive Officer.

Company Overview

Established in 1973, Deckers (NYSE:DECK) is a footwear and apparel conglomerate with a portfolio of lifestyle and performance brands.

Footwear

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

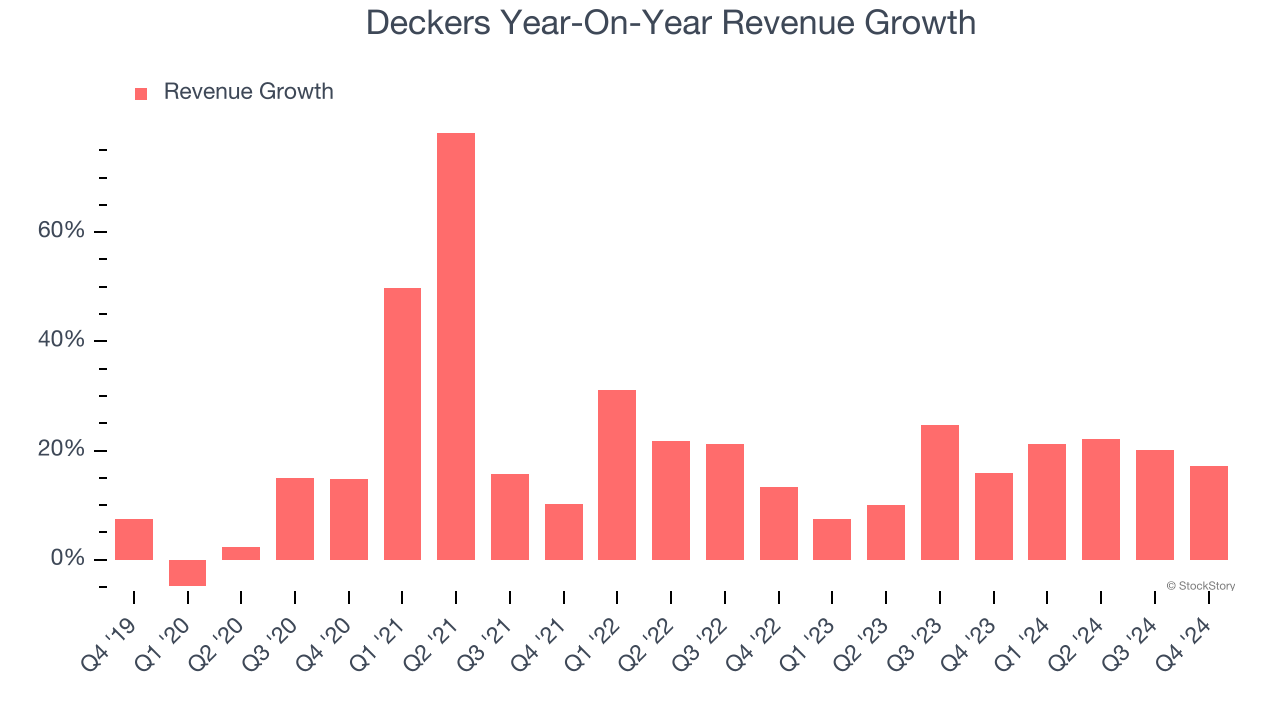

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Deckers grew its sales at a solid 18% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Deckers’s annualized revenue growth of 17.4% over the last two years aligns with its five-year trend, suggesting its demand was stable.

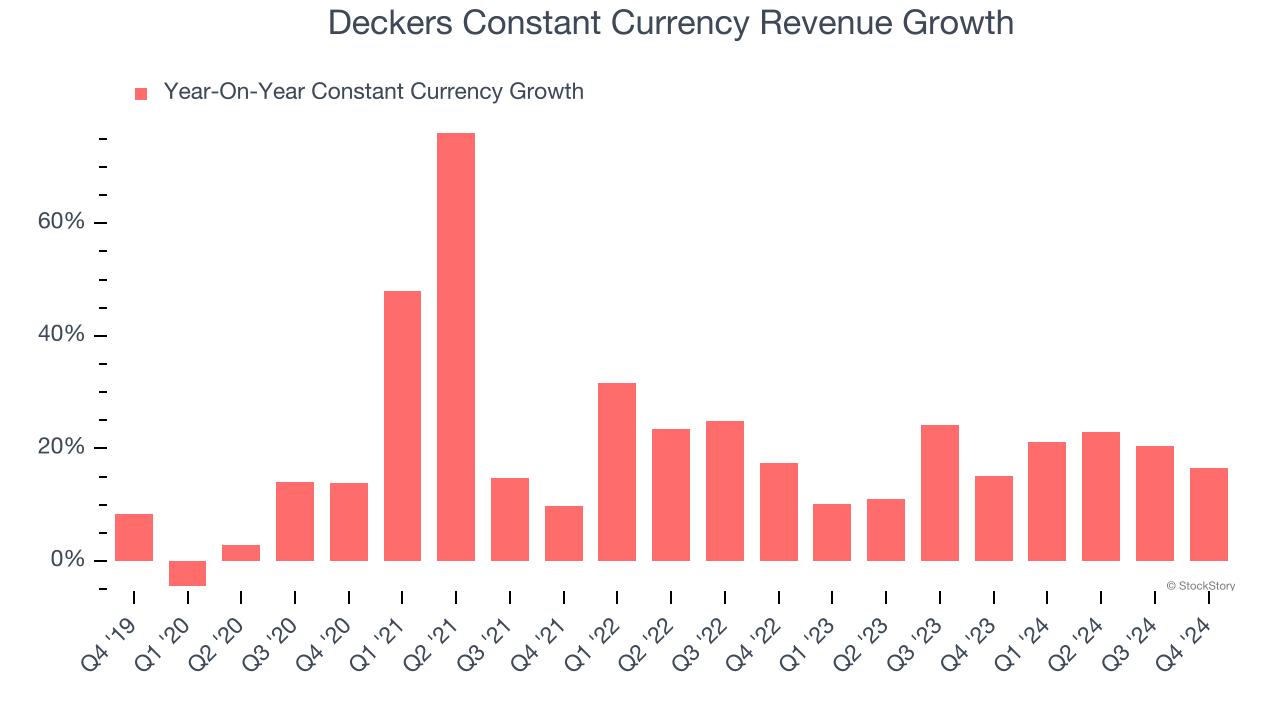

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 17.7% year-on-year growth. Because this number aligns with its normal revenue growth, we can see Deckers’s foreign exchange rates have been steady.

This quarter, Deckers reported year-on-year revenue growth of 17.1%, and its $1.83 billion of revenue exceeded Wall Street’s estimates by 5.5%.

Looking ahead, sell-side analysts expect revenue to grow 8.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

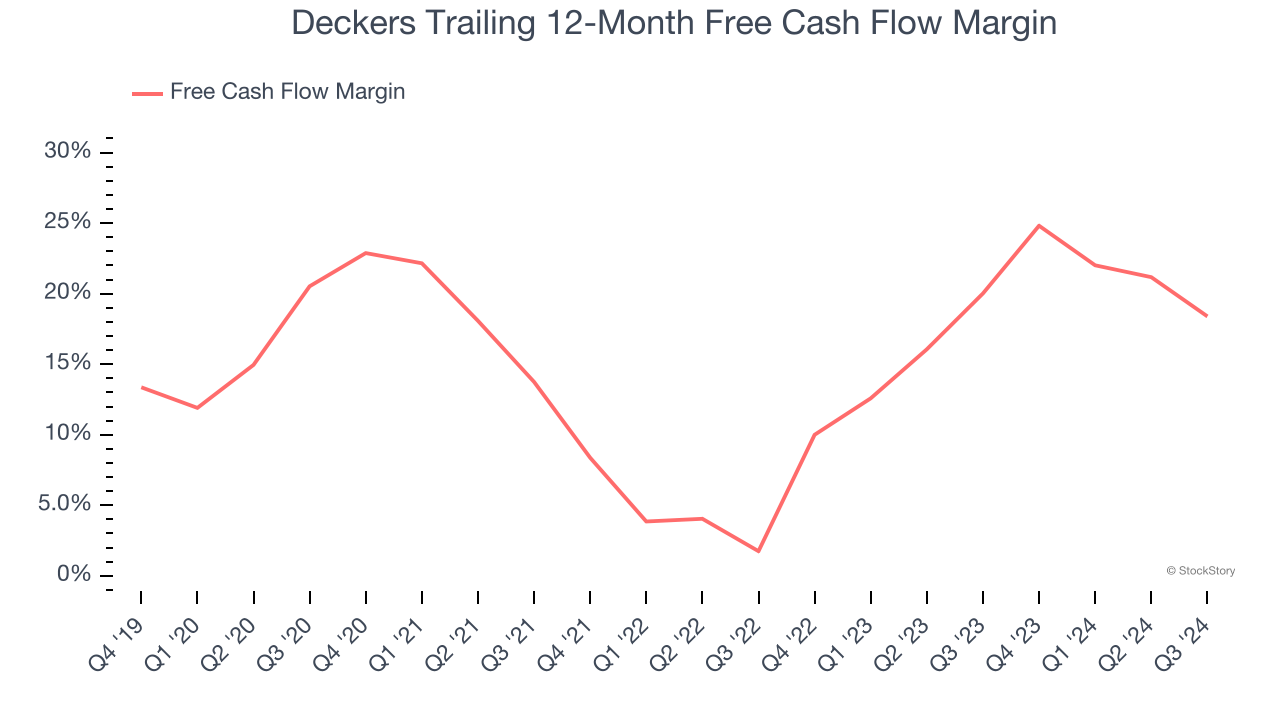

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Deckers has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 13.2% over the last two years, better than the broader consumer discretionary sector.

Key Takeaways from Deckers’s Q4 Results

We were impressed by how significantly Deckers blew past analysts’ constant currency revenue and EPS estimates this quarter. On the other hand, its full-year revenue guidance slightly missed even though the company raised it. Overall, this "beat and raise" quarter had some key positives, but the market was expecting even better results (implied by its 39x forward P/E ratio before the earnings release, which is high for a consumer company). The stock traded down 15.9% to $187.34 immediately following the print.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.